Building a Budget that Works for You: Strategies and Tips

January 21, 2024 2024-01-21 20:39Building a Budget that Works for You: Strategies and Tips

Introduction

Managing your finances can sometimes feel like a daunting task, especially when it comes to creating and sticking to a budget. However, building a budget that works for you doesn’t have to be a complicated process. With the right strategies and tips, you can take control of your finances and achieve your financial goals. In this blog post, we will explore some effective strategies and provide practical tips to help you build a budget that works for you.

1. Set Clear Financial Goals

Before you start creating your budget, it’s important to set clear financial goals. Whether you want to save for a down payment on a house, pay off debt, or plan for retirement, having specific goals in mind will give your budget a purpose. Write down your goals and make sure they are realistic and achievable.

2. Track Your Income and Expenses

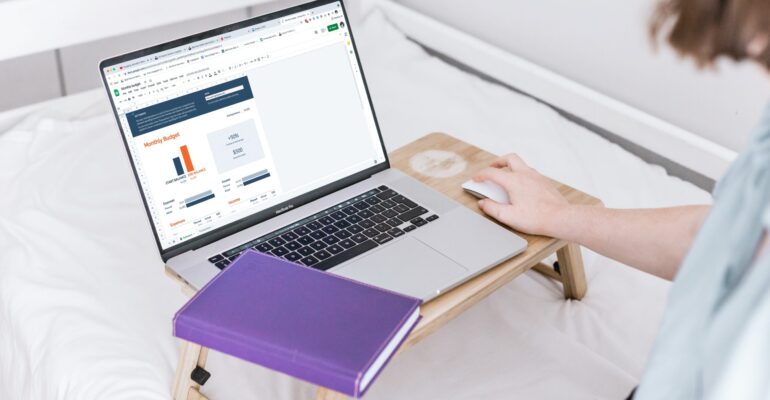

One of the first steps in building a budget is to track your income and expenses. Start by listing all your sources of income and then track your expenses for a month. This will give you a clear picture of where your money is coming from and where it’s going. There are many budgeting apps and tools available that can help you easily track your income and expenses.

3. Categorize Your Expenses

Once you have tracked your expenses, categorize them into different categories such as housing, transportation, groceries, entertainment, and so on. This will help you identify areas where you can cut back and allocate more funds towards your financial goals.

4. Prioritize Your Spending

After categorizing your expenses, it’s time to prioritize your spending. Determine which expenses are essential and which ones can be reduced or eliminated. For example, you may need to cut back on eating out or cancel unnecessary subscriptions to free up more money for your financial goals.

5. Create a Realistic Budget

Now that you have a clear understanding of your income, expenses, and financial goals, it’s time to create a realistic budget. Make sure your budget aligns with your goals and takes into account any irregular expenses or unexpected costs. Be realistic about your income and avoid overestimating it.

6. Automate Your Savings

One of the best ways to ensure you stick to your budget and save money is to automate your savings. Set up automatic transfers from your checking account to a separate savings account or investment account. This way, you won’t have to rely on willpower alone to save money.

7. Review and Adjust Regularly

A budget is not a set-it-and-forget-it tool. It’s important to regularly review and adjust your budget as needed. Life circumstances change, and your budget should reflect those changes. Review your budget monthly or quarterly and make adjustments as necessary.

8. Stay Motivated

Building a budget and sticking to it can be challenging at times. It’s important to stay motivated and remind yourself of your financial goals. Celebrate small wins along the way and visualize the long-term benefits of sticking to your budget.

Conclusion

Building a budget that works for you is an essential step towards financial well-being. By setting clear goals, tracking your income and expenses, prioritizing your spending, and regularly reviewing and adjusting your budget, you can take control of your finances and achieve your financial goals. Remember, building a budget is a journey, and it may take time to find the right balance. Stay committed, stay motivated, and enjoy the financial freedom that comes with a well-planned budget.